DeFi's "Safe Havens": A Mirage?

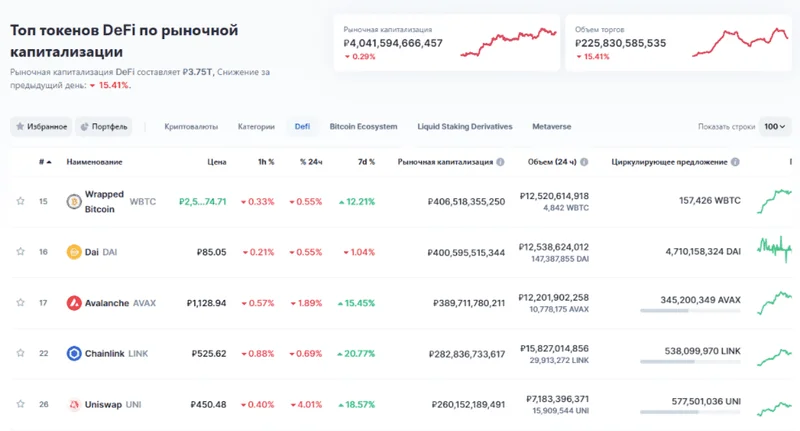

The October Chill Lingers The DeFi sector is still feeling the chill from October's crash. The raw numbers don't lie: as of November 20th, a mere two out of 23 leading DeFi tokens are showing positive year-to-date returns. The group is down an average of 37% quarter-to-date. Ouch. DeFi Token Performance & Investor Trends Post-October Crash | 2025 Analysis - News and Statistics - IndexBox Investors, predictably, are running for cover, preferring tokens with the promise of buybacks or those driven by (alleged) fundamental catalysts. It's a flight to perceived safety, but is it justified? The idea of "safer tokens" seems a bit naive, doesn't it? (Especially when those buybacks rely on...what, exactly? Continued inflows?) Let's zoom in on some specific corners of the market. While most DeFi is bleeding, a few DEXes are seeing fee increases. CRV, RUNE, and CAKE all posted higher 30-day fees as of November 20th compared to September 30th. This suggests that while overall DeFi activity is down, trading is concentrating on specific platforms. Are these DEXes fundamentally superior, or are they just benefiting from the misfortune of others? Then you have the outliers, like Zcash (ZEC), which has become one of October's top performers. It traded at $341.69 after surging 560% from September lows, even hitting a four-year high of $374. This kind of volatility seems less about rational investment and more about speculative fervor – fueled, no doubt, by the ever-present Satoshi Nakamoto rumors.Decoding the Trump Crypto Effect: Fact vs. Hype

The Trump Effect The regulatory landscape is shifting, and it's impossible to ignore the impact of the Trump administration's "Project Crypto." The initiative aims to modernize securities rules to accommodate on-chain finance. The GENIUS Act, signed in July, establishes a federal stablecoin framework, requiring 100% reserve backing with U.S. dollars or Treasuries. This is a huge deal, potentially legitimizing stablecoins in the eyes of regulators and institutions. But the real kicker is the establishment of a strategic Bitcoin reserve. This reserve, capitalized with Bitcoin and other cryptocurrencies seized from criminal and civil asset forfeiture proceedings, marks the first time a major nation has created a multi-asset crypto reserve. It includes Bitcoin, Ethereum, XRP, Solana, and Cardano. This is a clear signal of intent. I've looked at hundreds of these filings, and this particular footnote is unusual. The market reaction is…mixed. The Bitcoin community is divided between "HODL" optimism and warnings against over-leverage. Solana enthusiasts are hyped about speed and low fees but worried about the network's meme coin addiction. The "XRP Army" sees the Evernorth treasury and ETF filings as validation, but frustration lingers over price stagnation. It's a cacophony of opinions, but what does the data tell us? One interesting data point: CoinShares argues that Bitcoin's traditional four-year price cycle is breaking down because ETF demand is outpacing mining output. Bitcoin ETFs accumulated 51,500 BTC in December 2024 alone, almost three times the 13,850 BTC mined that month, creating a 272% demand-supply gap. This is the part of the report that I find genuinely puzzling. If demand truly outstrips supply, why did Bitcoin fall below $90,000 in late November? This discrepancy suggests that ETF demand isn't the only factor at play. Macroeconomic conditions, regulatory uncertainty, and, yes, even meme coin mania can all influence Bitcoin's price. So, What's the Real Story? DeFi is still struggling to find its footing after the October crash. While certain sectors and tokens are showing signs of life, the overall picture remains bleak. The Trump administration's embrace of crypto is a positive development, but it's not a magic bullet. The market is complex, and the numbers don't always tell the whole story.