Dethroning Wall Street: The ICO Revolution Begins

The ICO Tsunami: Funding Reimagined Let's get real for a second. The traditional financial system? Antiquated. Centralized. Exclusionary. It’s like trying to run a 21st-century economy on a system designed for the 18th. We're talking about a world where nearly half of all financial intermediaries are hit by economic crime *every single year*. That's insane!Blockchain: More Than Bitcoin, It's a Revolution

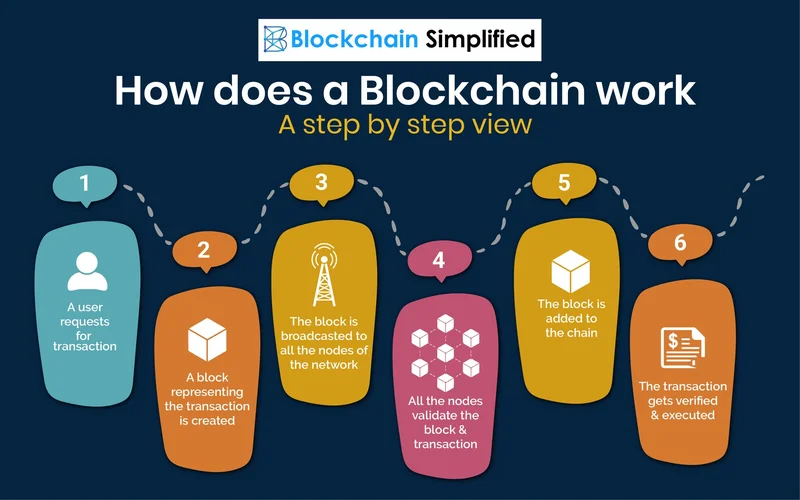

Blockchain's Disruptive Potential Born from the ashes of the 2008 financial crisis as the tech powering Bitcoin, blockchain promised secure, peer-to-peer transactions without the need for those clunky, expensive intermediaries. It's not just about cutting out the middleman; it's about empowering individuals, fostering collaboration, and slashing transaction costs to the bone. Santander estimates we could save $20 billion *a year* just by using blockchain! Capgemini thinks consumers could pocket another $16 billion in banking and insurance fee savings.ICOs: Crowdfunding the Future, One Token at a Time

ICOs: A New Funding Model Emerges Then came the ICOs. Think of them as… well, imagine Kickstarter meets the stock market, but for blockchain startups. Instead of offering equity, companies offer digital tokens, often representing access to a platform or a share of future profits. In 2016, blockchain companies raised $400 million from traditional venture investors. Not bad! But then, almost out of nowhere, they raised *another* $200 million through ICOs. And in 2017? The expectation is that ICOs will dwarf *every other* funding method.VCs Are Diving Headfirst Into the Crypto Revolution

Mainstream Adoption and VC Interest This is a paradigm shift, folks. Even the big players are taking notice. Union Square Ventures, not exactly known for being reckless, broadened its investment strategy to buy ICOs directly. Andreessen Horowitz, another VC heavyweight, joined USV in backing Polychain Capital, a hedge fund that *only* buys tokens. And get this: Blockchain Capital announced it would raise money for its *new fund* by issuing tokens via an ICO! The snake is eating its own tail, in the best possible way.ICOs: Taming the Wild West of Innovation

Navigating the Risks of the ICO Wild West Now, I know what you're thinking: "This sounds too good to be true." And you're right, there are risks. ICOs are still the Wild West. There's little to no regulatory oversight, and due diligence and disclosures can be… shall we say, *scant*. But here's the thing: every revolution has its growing pains. The printing press allowed for the mass distribution of knowledge, but also for the spread of misinformation. The internet connected the world, but also created new avenues for fraud. Does that mean we should abandon these technologies? Absolutely not! It means we need to be smart, be vigilant, and build the safeguards necessary to protect ourselves.ICOs: Unleashing a Cambrian Explosion of Innovation?

Unlocking Innovation Across Industries What really excites me is the sheer *breadth* of innovation that ICOs are unlocking. We're talking about content and digital rights management platforms, distributed venture funds, platforms to manage digital assets… the possibilities are endless! Think about SingularDTV, the DAO, ICONOMI, Cosmos – these are just the tip of the iceberg.Blockchain's Wall Street Debut: A New Era of Finance?

Financial Institutions Embrace Blockchain Companies like JPMorgan Chase, Citigroup, and Credit Suisse are investing in blockchain technology. Goldman Sachs, NASDAQ, Inc., and Intercontinental Exchange have been among the largest investors in blockchain ventures. They see the writing on the wall: blockchain isn't just a fad, it's the future. As the Harvard Business Review reports, blockchain is poised to revolutionize the financial landscape.Beyond Bitcoin: A Revolution in Identity, Trust, and Access

Beyond Finance: A Vision for the Future But it's not just about the money. Blockchain could upend everything: identity and reputation, payments and remittances, savings, credit, marketplaces, insurance and risk management, audit and tax functions. Imagine a world where your identity is secure and unhackable, where you can send money across borders instantly and without fees, where you have access to credit no matter your background…Blockchain: A New Era of Power, A New Era of Ethics

The Promise and Responsibility of Blockchain That's the promise of blockchain. That's the promise of ICOs. Of course, with this new power comes responsibility. We need to think long and hard about the ethical implications of this technology. How do we ensure that it's used for good, and not for ill? How do we protect the vulnerable from scams and fraud? These are tough questions, but they're questions we *must* answer if we want to build a better future.Democratizing Finance: Building a Better World, Brick by Brick

A Rocket Ship to Tomorrow This isn't just about money; it's about empowerment. It's about giving individuals the tools they need to build a better world. It's about democratizing finance and creating a more equitable future for all.